Are you ready to take control of your financial destiny? In today’s fast-paced world, it’s crucial to have the knowledge and skills to navigate the complex world of personal finances. That’s where financial intelligence comes in. Defined as the ability to understand and effectively utilize financial information, financial intelligence is a powerful tool that can help you make informed decisions, plan for the future, and ultimately achieve financial success. By unlocking the secrets of financial intelligence, you can finally take charge of your money and set yourself up for a lifetime of financial stability. So, let’s dive into the world of financial intelligence and discover the key principles that will empower you to master your finances.

Why Financial Intelligence is Important

Financial intelligence is a vital skill to possess in today’s fast-paced and ever-changing world. Without it, individuals may find themselves struggling to make informed decisions about their money, leading to financial instability and missed opportunities. Developing financial intelligence enables individuals to effectively manage their finances, make prudent investment choices, and achieve long-term financial goals.

One key reason why financial intelligence is important is that it empowers individuals to take control of their financial lives. By understanding concepts such as budgeting, saving, and investing, individuals can make well-informed decisions that align with their financial aspirations. They can avoid unnecessary debt, create a robust savings plan, and make strategic investment decisions to build wealth over time. Financial intelligence provides the knowledge and skills needed to navigate the complex world of personal finance confidently.

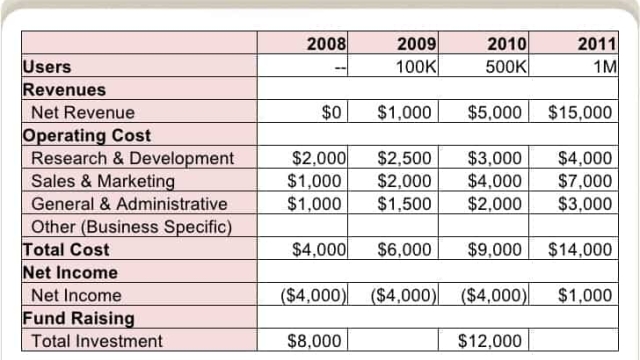

Furthermore, financial intelligence helps individuals make sound investment choices. In today’s market, investment opportunities are plentiful, but without the necessary knowledge, individuals may fall victim to scams or make ill-advised investments. With financial intelligence, individuals can analyze investment options, assess risks, and evaluate potential returns. This allows them to make informed decisions that align with their risk tolerance and financial goals, increasing their chances of financial success.

In addition, financial intelligence plays a crucial role in achieving long-term financial goals. Whether it’s saving for retirement, buying a home, or starting a business, having a solid understanding of personal finance is essential. Financial intelligence allows individuals to develop effective strategies, set realistic goals, and take actionable steps toward achieving them. By making informed decisions and managing money wisely, individuals can transform their financial aspirations into a reality.

In conclusion, financial intelligence is of utmost importance in today’s world. It equips individuals with the knowledge and skills needed to take control of their financial lives, make wise investment choices, and achieve their long-term financial goals. By prioritizing the development of financial intelligence, individuals can unlock the secret to mastering their finances and pave the way to a secure and prosperous future.

Developing Financial Intelligence: Key Strategies

When it comes to mastering your finances and achieving financial intelligence, there are several key strategies that can pave the way for success:

Set Clear Financial Goals: Setting clear and specific goals is essential in developing financial intelligence. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having concrete objectives helps guide your financial decisions and actions.

Educate Yourself: Knowledge is power, especially when it comes to finances. Take the time to educate yourself about personal finance topics such as budgeting, investing, and managing debt. There are plenty of resources available, from books and podcasts to online courses, to help you gain the necessary financial knowledge and skills.

Payment ProcessorsPractice Consistency and Discipline: Developing financial intelligence requires consistent effort and discipline. Make a habit of regularly reviewing your financial situation, tracking your expenses, and sticking to a budget. It’s important to be mindful of your spending habits and make conscious choices that align with your financial goals.

By implementing these key strategies and developing financial intelligence, you can take control of your financial future and make informed decisions that lead to long-term financial success. Remember, building financial intelligence is a journey, and it requires commitment and dedication. Stay focused, stay informed, and keep working towards your financial goals.

Applying Financial Intelligence to Take Control of Your Finances

When it comes to taking control of your finances, the power of financial intelligence cannot be understated. By developing a strong understanding of how money works and making informed decisions, you can pave the way to a more secure and prosperous future.

A key aspect of applying financial intelligence is gaining clarity on your financial goals. It’s important to define your short-term and long-term objectives, whether it’s saving for a down payment on a house or planning for retirement. By knowing what you want to achieve, you can align your financial decisions and actions accordingly.

Another vital element is practicing effective budgeting. Creating a budget allows you to track your income and expenses, giving you visibility into where your money is going. With this knowledge, you can make adjustments as needed, such as cutting back on unnecessary expenses or allocating more funds towards savings and investments.

Lastly, financial intelligence involves making informed investment choices. Understanding different investment options and their associated risks can help you make smarter decisions with your money. Whether it’s stocks, bonds, real estate, or other investment vehicles, having the knowledge to evaluate opportunities and manage risks can greatly impact your financial success.

In summary, leveraging financial intelligence to take control of your finances requires setting clear goals, implementing effective budgeting strategies, and making informed investment decisions. By incorporating these principles into your financial journey, you can unlock the secret to mastering your finances and pave the way to a more prosperous future.

Recent Comments