Utah, also known as the Beehive State, is home to a vibrant and diverse business landscape. From bustling city centers to scenic mountain towns, entrepreneurs across the state are constantly seeking opportunities to thrive and grow. However, with great opportunities come great risks, making it vital for businesses to protect themselves with the right insurance coverage.

In this comprehensive guide to business insurance in Utah, we’ll explore the various types of insurance policies available and provide valuable insights to help you safeguard your business in this dynamic state. Whether you’re a general contractor looking for insurance coverage tailored to your trade or a hotel owner in need of protection against unforeseen events, we’ve got you covered. So, let’s dive into the world of business insurance in Utah and ensure the longevity and success of your enterprise.

Understanding Business Insurance in Utah

Utah is known for its thriving business environment, making it an attractive state for entrepreneurs and business owners. However, it’s crucial to protect your business against potential risks and uncertainties that can arise. This is where business insurance in Utah plays a vital role.

As a business owner in Utah, understanding the different types of business insurance coverage available is essential. One common type is insurance for general contractors, which provides coverage for construction-related risks. Whether you are a residential or commercial contractor, having this insurance can safeguard your business against potential liabilities, accidents, and property damage.

For businesses operating in the hospitality industry, such as hotels and resorts, specialized insurance coverage is crucial. This type of insurance is designed to protect against risks specific to the hospitality sector. From guest injuries to property damage, having proper insurance coverage can provide peace of mind and ensure your business is protected.

In conclusion, business insurance in Utah is a necessity for protecting your investment and ensuring the long-term success of your business. Understanding the specific insurance needs of your industry, such as insurance for general contractors or insurance for hotels, is key to finding the right coverage. By adequately insuring your business, you can focus on growing and thriving in the Beehive State.

Insurance for General Contractors: A Comprehensive Guide

General contractors play a vital role in the construction industry, overseeing various projects and ensuring their successful completion. With the inherent risks involved in this line of work, it is crucial for general contractors in Utah to have proper insurance coverage to protect their businesses. In this comprehensive guide, we will explore the key aspects of insurance for general contractors and explain why it is essential for their long-term success.

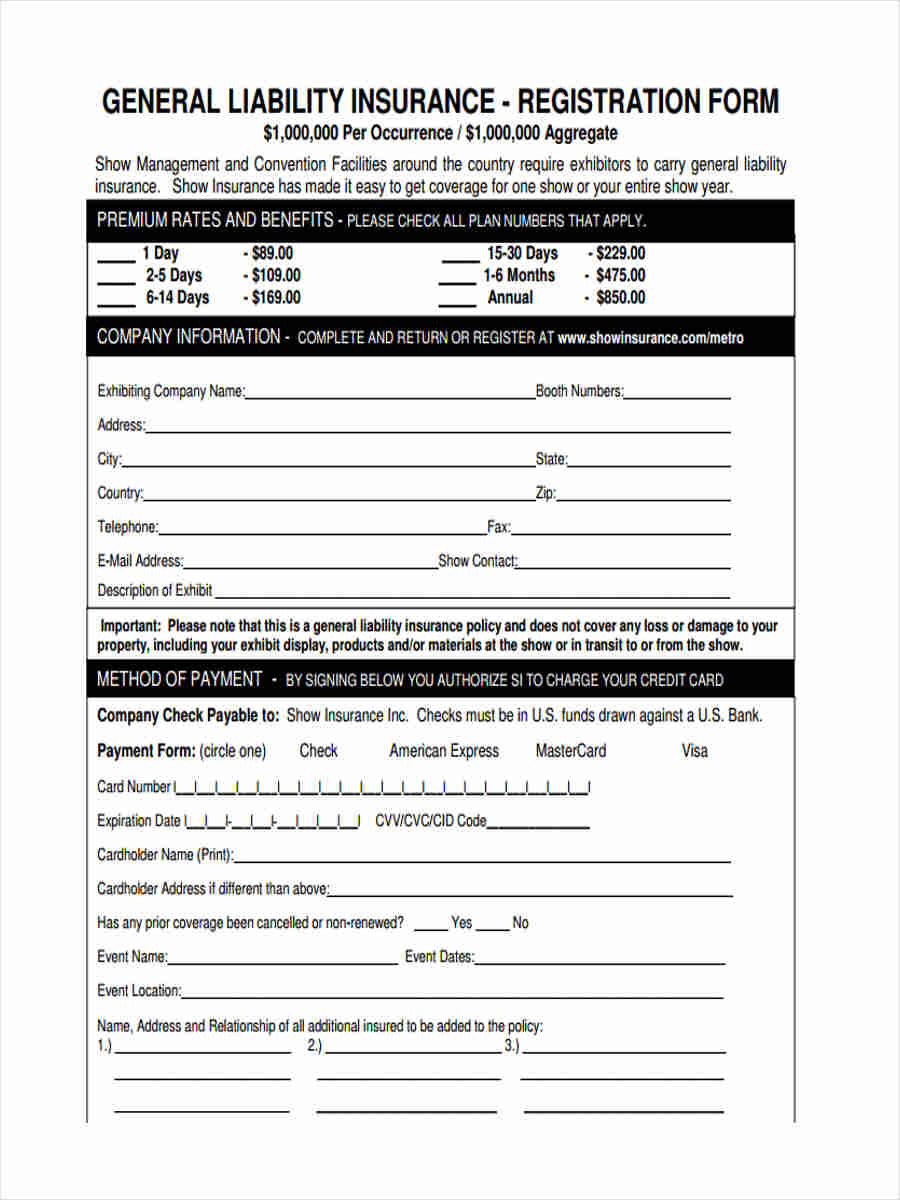

First and foremost, one of the primary insurance policies that general contractors in Utah should consider is general liability insurance. This policy provides coverage for third-party bodily injury, property damage, and personal injury claims that may arise during the course of their work. Whether it’s accidental damage to a client’s property, a slip and fall accident on a construction site, or a lawsuit due to alleged negligence, general liability insurance ensures that contractors are financially protected from potential claims and lawsuits that could otherwise jeopardize their businesses.

Another crucial insurance policy for general contractors is workers’ compensation insurance. Construction sites can be inherently hazardous, and accidents resulting in injuries to workers are unfortunately not uncommon. Workers’ compensation insurance provides coverage for medical expenses, rehabilitation costs, and lost wages for employees who are injured on the job. By carrying this insurance, contractors not only fulfill their legal obligations but also demonstrate their commitment to the well-being of their employees, fostering a safe and positive work environment.

Additionally, general contractors should also consider professional liability insurance, also known as errors and omissions insurance. This policy protects contractors from claims arising from professional mistakes, negligence, or inadequate work performance. In the construction industry, even the smallest oversight or error can lead to significant financial consequences for both the contractor and their clients. Professional liability insurance provides coverage for legal defense costs, settlements, and judgments, ensuring that contractors can continue their operations without bearing the full brunt of such claims.

In conclusion, insurance for general contractors in Utah is not just a recommended precaution but an essential aspect of running a successful construction business. From general liability insurance to workers’ compensation and professional liability insurance, these policies provide financial protection and peace of mind in an industry where risks are inevitable. By understanding the importance of comprehensive insurance coverage and working closely with trusted insurance providers, general contractors can protect their livelihoods and focus on what they do best: building and serving the Beehive State with utmost professionalism and dedication.

Protecting Your Hotel Business with the Right Insurance

As a hotel owner in Utah, it is crucial to safeguard your business with the right insurance coverage. The hospitality industry can be unpredictable, and having the appropriate insurance policies in place will provide you with peace of mind and financial protection. Here are some key insurance considerations for your hotel business in the Beehive State.

First and foremost, property insurance is essential for any hotel owner. This type of insurance will protect your building, furnishings, and equipment from damage caused by fire, natural disasters, or other unforeseen events. With proper property insurance coverage, you can confidently face any unexpected property damage and ensure that your business operations are not severely affected.

Liability insurance is another crucial aspect of protecting your hotel business. Accidents can happen, and hotel guests may sometimes hold you responsible for their injuries or property damage. Liability insurance will cover legal costs, medical expenses, and potential settlements that may arise from these situations. It is important to have adequate liability coverage to protect both your business and your guests.

Insurance For Hotels

Furthermore, consider obtaining business interruption insurance. This type of insurance will provide financial support if your hotel operations are disrupted due to a covered event, such as a fire or a natural disaster. Business interruption insurance can help you cover ongoing expenses, such as staff salaries and mortgage payments, during the period of restoration. This coverage can be a lifeline in times of unforeseen circumstances and help your hotel business recover smoothly.

In conclusion, ensuring the right insurance coverage for your hotel business in Utah is vital for safeguarding your investment and protecting your financial stability. Property insurance, liability insurance, and business interruption insurance are key components to consider when building a comprehensive insurance portfolio. By being prepared and proactive in your insurance choices, you can ensure the long-term success and resilience of your hotel business in the Beehive State.

Recent Comments